Browsing the Fast Track: Get To New Levels With Our Streamlined Hard Cash Loans

Are you all set to get to brand-new elevations with our structured hard cash lendings? With our fast approval procedure, you can browse the rapid lane to success. Discover the advantages of our reliable system and just how it can assist you confiscate financial investment opportunities. In this article, we will certainly give pointers for a smooth car loan application and help you comprehend the difference in between hard money loans and conventional loans. Do not lose out on this possibility to take your monetary future to new heights.

The Benefits of Streamlined Hard Money Loans

You'll love the benefits of our streamlined difficult cash financings. With our lendings, you can appreciate a quick and easy application procedure. Gone are the days of extensive documents and waiting on weeks to get accepted. Our streamlined procedure permits you to apply online and obtain a choice in just a couple of days. This implies you can obtain the funding you need faster and begin working with your job quicker.

Another excellent advantage of our structured difficult money fundings is the versatile terms we provide. We comprehend that every job is one-of-a-kind and may need various payment choices. That's why we work closely with you to produce a financing bundle that suits your details needs. Whether you require a short-term financing or a longer repayment duration, we've got you covered.

In addition, our structured tough money finances offer affordable rates of interest. We aim to give our customers with one of the most cost effective funding options offered. By maintaining our prices low, we assist you save cash and optimize your return on financial investment.

Lastly, our streamlined difficult cash car loans come with marginal needs. This makes it less complicated for you to certify for a financing, even if you do not have a perfect debt rating.

Exactly How Our Quick Approval Refine Can Help You Get To New Levels

Get prepared to skyrocket towards your objectives with our lightning-fast authorization process. Time is of the essence when it comes to getting to brand-new elevations. That's why our streamlined difficult cash lendings are designed to provide you fast accessibility to the funds you need. With our quick approval process, you can bypass the lengthy documents and limitless waiting that frequently includes traditional car loans.

Envision this: you have a gold opportunity to purchase a building that has the prospective to generate significant returns. But to confiscate this opportunity, you require financing, and you need it quickly. That's where our rapid authorization process is available in. We recognize that timing is vital on the planet of property, and we don't want you to miss out on out on any lucrative deals.

With our lightning-fast approval process, you can send your funding application and obtain a decision in document time. Say goodbye to waiting weeks and even months for a reaction. We make every effort to offer you with a smooth experience that permits you to relocate onward with your strategies right away.

Whether you're a seasoned financier or just starting, our quick approval procedure can aid you achieve your financial goals. Why wait? Take the initial step towards getting to brand-new heights and get our structured difficult cash loan today. The future is within your grasp.

Navigating the Quick Lane: Tips for a Smooth Loan Application

Imagine obtaining a finance and efficiently browsing the fast track with these practical suggestions. When it involves protecting a lending, time is important, and you desire the process to be as smooth as possible. To begin, gather all the needed documents beforehand. This includes your evidence of revenue, identification, and any type of other appropriate monetary information. By having everything ready, you can swiftly offer the needed documents when it is asked for, saving priceless time.

Next, do your research and research different loan providers. Try to find reputable firms that concentrate on rapid authorization finances. hard money lender atlanta. Read testimonials, compare rates of interest, and check their lending requirements. This will aid you choose the finest lender that matches your needs and ensures a smooth application process.

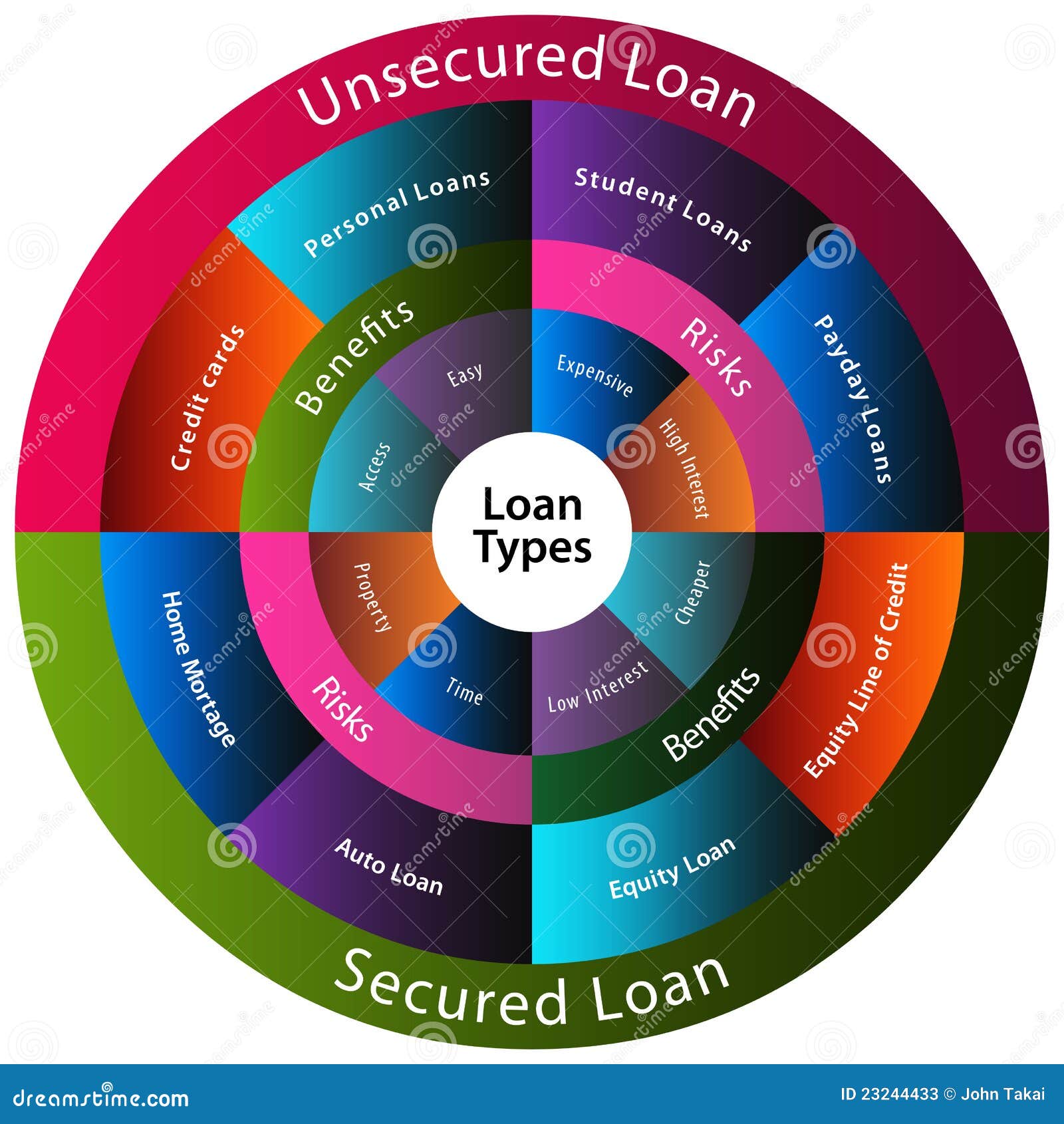

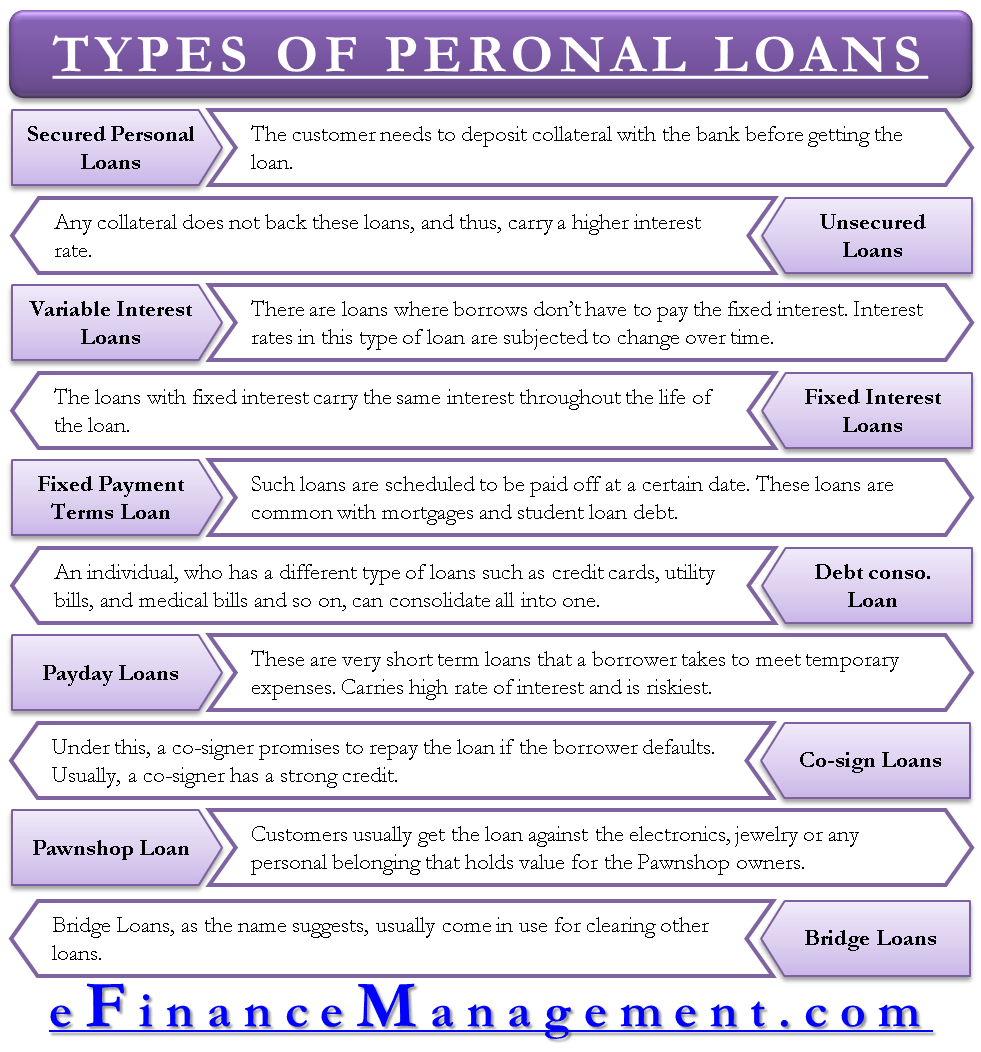

Understanding the Difference: Hard Cash Loans Vs. Typical Fundings

Exactly How Our Streamlined Refine Can Assist You Confiscate Financial Investment Opportunities

Our simplified procedure can help you in taking benefit of investment chances. With our streamlined method, we make it less complicated than ever for you to seize the possibility to grow your wide range. Gone are the days of difficult paperwork and prolonged approval processes. We recognize that time is essential when it comes to investing, and that's why we have made our system to be fast and reliable.

From the minute you submit your application, our team of specialists leaps into action, working carefully to assess your info and provide you with a decision in a prompt manner. We value your time and strive to make the process as simple as possible, permitting you to concentrate on what genuinely matters-- making rewarding investments.

When accepted, we waste no time in getting the funds to you. Our quick funding system guarantees that you have the funding you require to take advantage of financial investment chances find out here now as quickly as they emerge. Whether you're index looking to broaden your property profile or purchase a promising startup, our simplified procedure will assist you browse the rapid lane and get to new heights in your financial investment trip.

Conclusion

So, if you're wanting to get to new elevations with your investments, our structured difficult cash finances are your ticket to success. With our fast authorization procedure, you can rapidly seize financial investment chances and navigate the fast track of actual estate. Do not allow conventional financings slow you down-- select our difficult money finances and experience the benefits of a structured procedure. Start and raise your financial investments today!

In this article, we will provide ideas for a smooth car loan application and help you recognize the difference between tough cash my sources fundings and typical loans.Recognizing the difference between tough money finances and conventional finances can help you make notified decisions about your funding alternatives. The authorization process for tough cash finances is normally faster and much less stringent compared to traditional fundings (hard money lender atlanta). It's vital to very carefully consider your particular economic demands and conditions when making a decision between a difficult money lending and a conventional car loan. Do not let typical fundings reduce you down-- select our difficult cash finances and experience the advantages of a streamlined process

:max_bytes(150000):strip_icc()/Term-Definitions_loan.asp-b51fa1e26728403dbe6bddb3ff14ea71.jpg)